south dakota vehicle sales tax rate

What Rates may Municipalities Impose. The South Dakota sales tax and use tax rates are 45.

Sales Use Tax South Dakota Department Of Revenue

One field heading that incorporates the term Date.

. Counties and cities can charge an additional local sales tax of up to 2 for a maximum. With local taxes the total sales tax rate is between 4500 and 7500. South dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average.

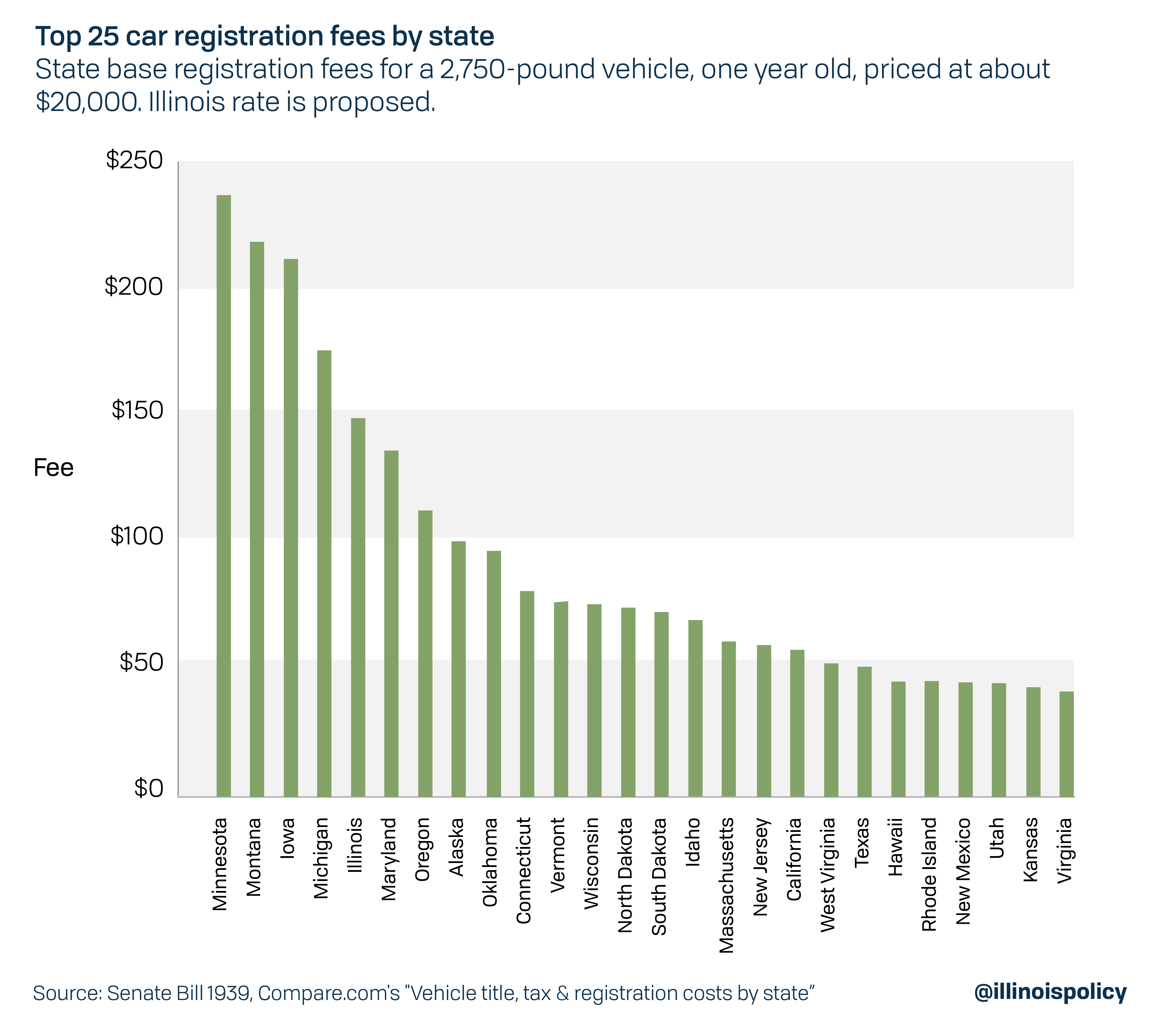

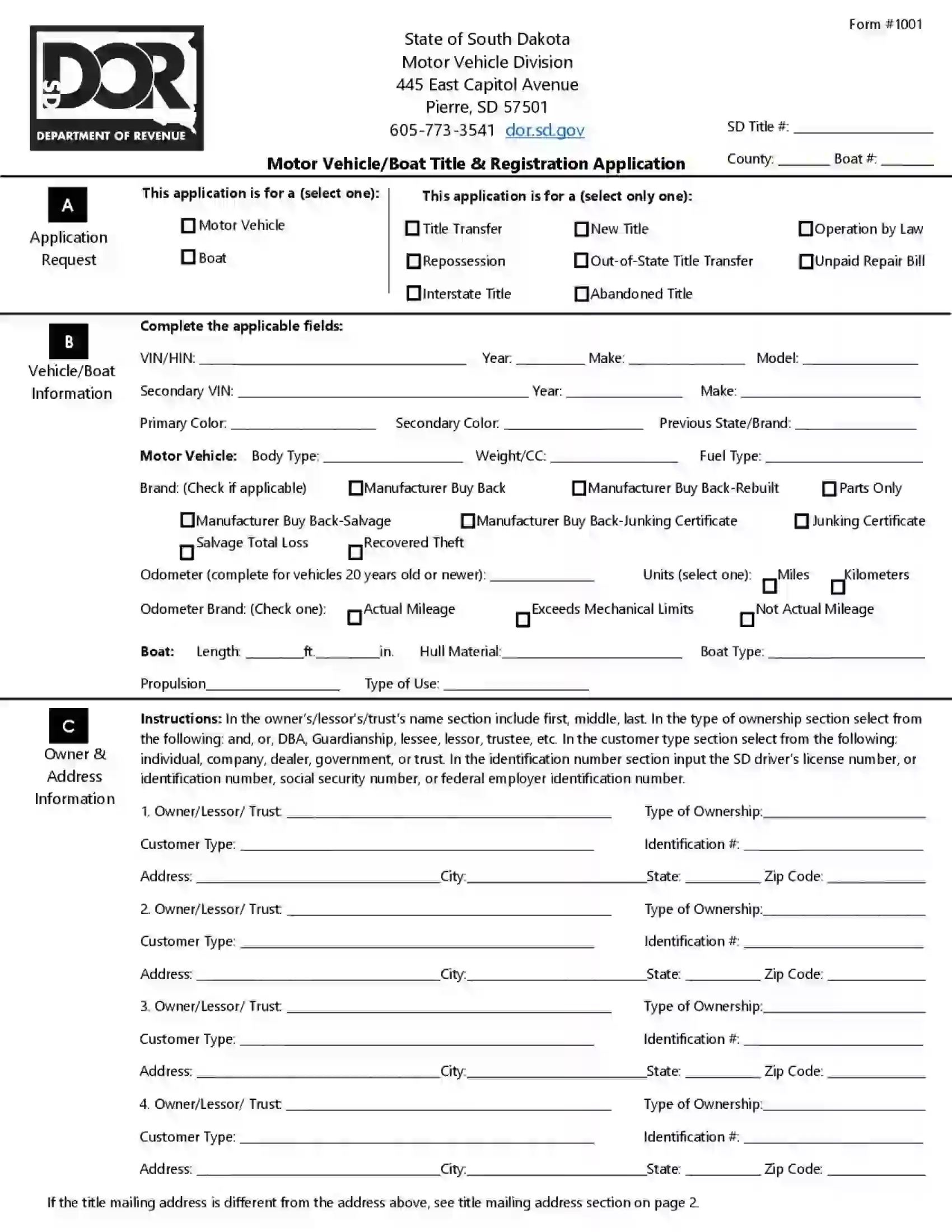

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. In addition for a car purchased in South Dakota there are other applicable fees including registration title and. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

All car sales in South Dakota are subject to the 4 statewide sales tax. What is South Dakotas Sales Tax Rate. How Much Is the Car Sales Tax in South Dakota.

The highest sales tax is in Roslyn with a. Different areas have varying additional sales taxes as well. Its important to note that this does include any local or county sales.

South Dakota has a 45 statewide sales tax rate but also has 290 local tax jurisdictions including cities towns counties and special districts that. 31 rows The state sales tax rate in South Dakota is 4500. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Rate search goes back to 2005. You have 90 days from your date of arrival to title and.

If a state with no tax or a lower tax rate than South Dakotas 4 then you will need to pay the additional tax rate to match the 4. South Dakota has recent rate changes Thu. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Car sales tax in South Dakota is 4 of the price of the car. Can I import a vehicle into.

South Dakota municipalities may impose a municipal. One field heading labeled Address2 used for additional address information. South Dakotas sales and use tax rate is 45 percent.

Average Local State Sales Tax.

How To File And Pay Sales Tax In South Dakota Taxvalet

All Vehicles Title Fees Registration South Dakota Department Of Revenue

Essential Guide On How To Establish South Dakota Domicile

How Do State And Local Sales Taxes Work Tax Policy Center

North Dakota Sales Tax Rates By City County 2022

Webster Area Development Corporation Financing Incentives

South Dakota Estate Tax Everything You Need To Know Smartasset

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

How To File And Pay Sales Tax In South Dakota Taxvalet

South Dakota License Plates Discover Baja Travel Club

Sales Tax On Cars And Vehicles In South Dakota

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Understanding California S Sales Tax

Sales Tax Laws By State Ultimate Guide For Business Owners