south carolina inheritance tax rate

That way a joint bank account will automatically pass to the surviving joint owner. It is one of the 38 states that does not have either inheritance or estate tax.

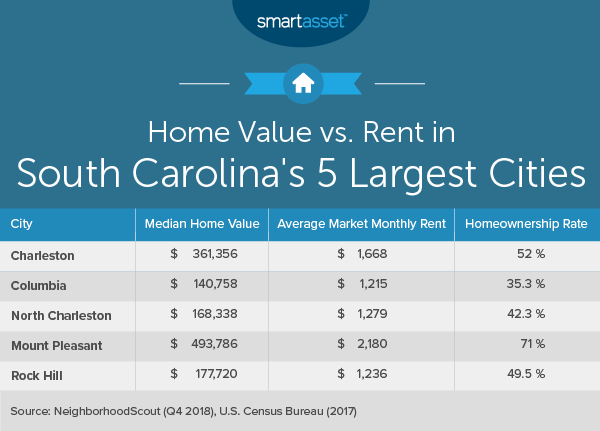

South Carolina Estate Tax Everything You Need To Know Smartasset

The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022.

. Detailed South Carolina state income tax rates and brackets are available on this page. The following five states do not collect a state sales tax. South Carolina does not have an estate or inheritance tax.

Keep reading for all the most recent estate and inheritance tax rates by state. Tax brackets are adjusted annually for. The District of Columbia moved in the.

No estate tax or inheritance tax. However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a part of the estate. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. A federal estate tax ranging from 18 to 40. However the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. Alaska Delaware Montana New Hampshire and Oregon. It is one of the 38 states that does not have either inheritance or estate tax.

Does South Carolina Have an Inheritance Tax or Estate Tax. No estate tax or inheritance tax. There is no inheritance tax in South Carolina.

No estate tax or inheritance tax. Massachusetts has the lowest exemption level at 1 million and DC. Eight states and the District of Columbia are next with a top rate of 16 percent.

State Sales Taxes. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. South Carolina also has no gift tax.

TN ST 67-8-202. 51 rows The estate tax rate is based on the value of the decedents entire taxable estate. South Carolina does not assess an inheritance tax nor does it impose a gift tax.

South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. Long-term gains which are held for at least one year receive a 44 deduction though. The top estate tax rate is 16 percent exemption threshold.

Maryland imposes the lowest top rate at 10 percent. Individual income tax rates range from 0 to a top rate of 7 on taxable income. However the federal government still collects these taxes and you must pay them if you are liable.

If a North Carolina resident inherits a property from a state that has an inheritance tax they become responsible for paying it. File Pay Check my refund status Request payment plan Get more information on the notice I received Get more information on the appeals process Contact the Taxpayer Advocate View South Carolinas Top Delinquent Taxpayers. South Carolina Inheritance Tax and Gift Tax.

TAX DAY NOW MAY 17th - There are -347 days left until taxes are due. Your federal taxable income is the starting point in determining your state income tax liability. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

Has the highest exemption level at 568 million. Does South Carolina Have an Inheritance Tax or Estate Tax. Individual Taxes Individual Income Estate Fiduciary Property Use.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. There are no inheritance or estate taxes in South Carolina.

For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state. Start filing your tax return now. Gains made on investments whether they were held for more than or less than one year are subject to the South Carolina income tax rates shown in the table above.

This chapter may be cited as the South Carolina Estate Tax Act. Pick-up tax is tied to federal state death tax credit. For example 62 localities in Alaska collect local sales taxes ranging from 1 percent to 7 percent.

There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be subject to it. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. Tax was permanently repealed in 2014 with repeal of all of SDCL 10-40A effective July 1 2014.

It has a progressive scale of up to 40. There are no inheritance or estate taxes in South Carolina. But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Not all estates must file a federal estate tax return Form 706. Make sure to check local laws if youre inheriting something from someone who lives out of state.

However some of these states find ways to collect taxes in other forms. However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

Moreover Maryland has both inheritance and estate taxes. 1 Decedent means a deceased person. Note that historical rates and tax laws may differ.

However the Palmetto States income tax is between 0 and 7 the 13th-highest in the country. No estate tax or inheritance tax. A strong estate plan starts with life insurance.

April 14 2021 by clickgiant. State inheritance tax rates in 2021 2022. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

2 Federal credit means the maximum amount of the credit for state death taxes allowable by Internal Revenue Code Section 2011. State Inheritance tax rate. Estate taxes generally apply only to wealthy estates while inheritance taxes.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Tax was permanently repealed in 2014 with repeal of all of SDCL 10-40A effective July 1 2014.

South Carolina Retirement Tax Friendliness Smartasset

The Ultimate Guide To South Carolina Real Estate Taxes

A Guide To South Carolina Inheritance Laws

A Guide To South Carolina Inheritance Laws

South Carolina Inheritance Laws King Law

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Real Estate Property Tax Data Charleston County Economic Development

Thinking About Moving These States Have The Lowest Property Taxes

South Carolina Estate Tax Everything You Need To Know Smartasset

Cost Of Living In South Carolina Smartasset

South Carolina Property Tax Calculator Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

South Carolina Sales Tax Small Business Guide Truic

States With No Estate Tax Or Inheritance Tax Plan Where You Die